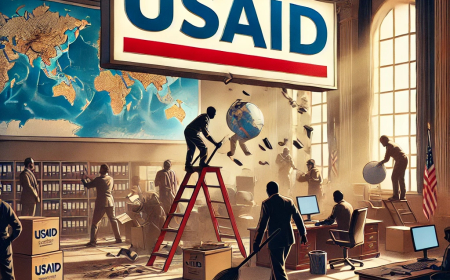

Trump's tariffs will be his own downfall

The U.S. economy will suffer unless, for some inexplicable reason, Trump can turn history on its head.

Apr. 2, 2025 may go down as one of the darkest days in American economic history. On that day, President Trump will unleash tariffs to make America and Americans really rich.

Despite all the lessons of history about why tariffs are disastrous policy, Trump clings to the delusion that they are the means to earn trillions and cut the $36 trillion debt. Some believe his love of tariffs (his favorite word, he says) goes back decades.

A few basic facts establish ground truth. The overall U.S. balance of payments, or that of any state, has two components. One is the trade balance of all goods and services. Here the U.S. imbalance has always been significant. For 2024, the U.S. had a negative trade imbalance of just over $900 billion.

The second is the capital account for net investments. For 2024, the U.S. surplus in this account is more than $2 trillion. So why has Trump ignored this? This is a problem.

It is unclear how or why Trump became so obsessed with trade deficits. Trump long believed that trade imbalances harmed the U.S. economy but he never said why.

Forty years ago, Trump criticized trade deficits, believing tariffs could encourage domestic manufacturing. Ironically, U.S. manufacturing has never been higher than it was just last year. But Trump has never been known for changing long-held opinions.

Trump's focus on tariffs and reducing the trade deficit stems from his longstanding belief that trade imbalances harm the U.S. economy. As early as the 1980s, he criticized trade deficits, arguing that they burden the country. He advocated for tariffs to promote domestic manufacturing. Trump does not seem to understand that the other side gets a vote too, which can easily lead to trade wars.

While the notion of “reciprocal tariffs” may seem reasonable, what prevents or incentivizes the other negotiating partner from abiding by Trump’s rule? There is nothing.

The 1930 Hoot-Smalley Tariffs helped create the Great Depression and cut international trade by about three-fifths. But Trump is unmoved.

Tariffs have several downsides. The first is higher prices for consumers. Tariffs are taxes on all imported goods. The extra costs are passed on to consumers, affecting the middle and lower classes and also increasing inflation.

Second is the threat of retaliation by trading partners. This makes U.S. goods sold in foreign markets far more expensive, driving down demand. In sectors with low profit margins, this would prove disastrous.

Tariffs can lead to supply chain disruptions due to uncertainty about price points and lead to halts or uncertain production, especially for cars and high tech, where just-in-time arrival is essential.

Economic growth will almost certainly decline. Investment uncertainty and the need to regulate employment with demand will be affected. This will lead to job losses, as is being seen in the U.S. today, and a slowdown.

This form of domestic protection will produce inefficiency and reduced competition, driving costs upwards. This in turn will assure greater inefficiency and reduced global competition as states look inwards and are reluctant to invest capital abroad due to these uncertainties.

Global relations, especially with China and others can only weaken alliances with friends and aggravate adversaries, angered with the deterioration of trade.

Finally, these financial tensions and effects on the trade balances will produce all forms of market volatility. Investor confidence will be harmed. Indeed, tariffs and the threat of more tariffs have already driven the Dow from above 45,000 to the upper 41,000s and the technology-intense NASDAQ is now down more than 1,000 points from six months ago.

When these tariffs are released on April 2, huge economic and financial disruptions will occur. The possibility of huge stock market declines is real. This will greatly affect lower and middle-class 401(k) holders who will lose much of their retirement holdings. And as prices and costs soar, inflation will rise as will costs of living.

Depending on how the economy moves over the next weeks until April 2, it is possible GDP will contract in the first quarter. Two consecutive quarters of declines constitutes a recession, with negative psychological consequences that will have a political impact.

Trump’s views of tariffs will prove destructive and delusionary. The U.S. economy will suffer unless, in some inexplicable way, Trump can turn history on its head.

Harlan Ullman Ph.D. is UPI’s Arnaud deBorchgrave Distinguished Columnist, a senior advisor at Washington D.C.’s Atlantic Council, the chairman of two private companies and the principal author of the doctrine of shock and awe. He and David Richards are authors of the forthcoming book, “The Arc of Failure: Can Decisive Strategic Thinking Transform a Dangerous World.”

What's Your Reaction?