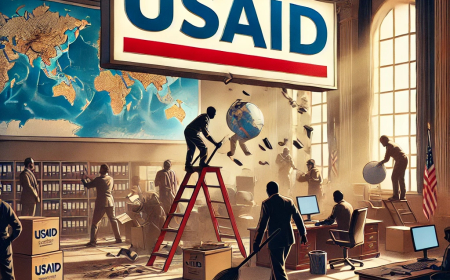

America’s Housing Crisis: Why the American Dream Feels Impossible Right Now

If you’ve been house-hunting lately, you know exactly what I’m talking about. The housing market in America is out of control, and for the average person, owning a home is starting to feel like a fantasy rather than a real goal.

And I don’t know about you, but I’m tired of hearing politicians, economists, and real estate “experts” give us their out-of-touch takes about why things are the way they are. "Interest rates are too high," "Supply is low," "The market is just adjusting!" They say all of this as if the average person can suddenly just accept renting forever.

The truth is, we’ve got a massive housing problem in this country, and the people in charge either don’t care or don’t have the guts to fix it. So, let’s break it down.

How Did Housing Get This Bad?

Just a few years ago, buying a house wasn’t easy, but it wasn’t impossible either. Then came COVID-19, government stimulus, supply chain issues, and Wall Street jumping into real estate, and before we knew it, we were looking at sky-high home prices, record-low inventory, and interest rates that make you want to cry.

Here’s what’s really happening:

-

Corporate Investors are Eating Up the Market

Regular people want to buy homes to live in them. But corporations? They’re snatching them up in bulk to rent them out at ridiculous prices. Companies like BlackRock and other big investors are buying up entire neighborhoods, driving up home prices, and forcing everyday Americans to stay renters for life. -

Not Enough Homes Are Being Built

You might hear politicians say, “We just need more homes!” Cool, great—but where are they? New home construction isn’t keeping up with demand, and when builders do break ground, they’re prioritizing luxury apartments and high-end homes because that’s where the most money is. Where’s the housing for working-class Americans? -

Interest Rates Are Making It Worse

Let’s talk about interest rates, because this is a huge reason why people are struggling to buy. Just three years ago, you could lock in a mortgage with a 3% interest rate. Today? It’s closer to 7% or higher. That might not sound like a big difference, but over the life of a loan, it can mean paying hundreds of thousands of dollars more for the exact same house. -

Wages Haven’t Kept Up

This one’s obvious. The cost of living has skyrocketed, but wages haven’t. People who were once able to afford a decent home on middle-class salaries are now completely priced out. Meanwhile, homeowners from previous generations act like younger buyers just aren’t trying hard enough—as if skipping Starbucks could somehow magically cover a $100,000 down payment.

Who’s to Blame?

This is the part where people usually point fingers at the government, banks, builders, corporations, or even other buyers. And honestly? It’s all of them.

- The government has let Wall Street treat housing like a stock market instead of a basic human need.

- Builders focus on profit over affordability.

- Corporations don’t care if regular people can’t buy homes because renting is more profitable.

- The Federal Reserve raised interest rates so high that financing a home feels impossible.

But instead of actual solutions, we get vague promises from politicians who claim they’re “looking into it.” What does that even mean? Looking into it won’t get people into homes.

So, What Can Be Done?

Let’s be real—this problem isn’t going to fix itself. We need real changes if we want the American dream to be achievable again. Here are some actual things that could help:

1. Limit Corporate Home Buying

There should be restrictions on how many homes corporations can buy, especially in residential areas. Regular Americans shouldn’t have to compete with billion-dollar investment firms just to buy a house.

2. Incentivize Affordable Housing Development

Developers need real financial incentives to build affordable housing, not just high-end homes and luxury rentals. Cities should be working with developers to prioritize middle-class housing instead of letting them flood the market with unaffordable options.

3. Reform Interest Rates for First-Time Home Buyers

Interest rates are killing affordability. Why not offer lower interest rates for first-time buyers instead of making them compete with cash-rich investors? If the government truly cared about housing accessibility, they’d make it easier—not harder—to buy a home.

4. Crack Down on Rent Price Gouging

Renters are being pushed to the limit, with landlords increasing rents by hundreds of dollars overnight. While some states have rent control laws, we need federal protections to stop excessive rent hikes. Housing should be stable, not a game of survival.

5. Reevaluate Zoning Laws

Many areas make it way too difficult to build housing by enforcing outdated zoning laws. If we really want to fix the housing shortage, cities and states need to loosen restrictions that prevent more housing options from being built.

Final Thoughts: Can This Actually Be Fixed?

The housing crisis isn’t some unfixable mystery. It’s the result of greed, bad policies, and a system that prioritizes profit over people. The solutions are right in front of us, but the people in charge have to actually care enough to do something.

So far, it seems like they don’t.

If this keeps up, we’re going to have a country where only the wealthy own homes, and everyone else is stuck in a lifetime of renting, struggling, and barely keeping up. That’s not the American dream—it’s a rigged system that only benefits the few.

The question is, how much worse does it have to get before we demand real change?

Until then, we’ll keep waiting. And the dream of homeownership? That’ll just keep slipping further out of reach.

Stay tuned to TrumpDaily.Live for more real conversations on the issues that actually matter.

By Mark Resse

What's Your Reaction?