Companies are unprepared for new tax tradeoff in 2025

As the Tax Cuts and Jobs Act is set to expire later this year, companies are preparing for potential trade wars and tariffs, and the White House is weighing a strategy that could include a tariff windfall to offset the cost of restructuring supply chains.

A tax tradeoff is on the horizon once again, and most companies are unprepared.

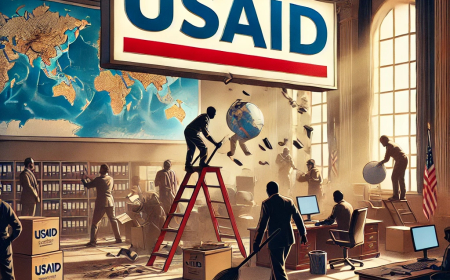

The world is quickly reacquainting itself with the chaos of the Trump administration. Companies are grappling with heightened uncertainty, hoping for another tax windfall but holding their breath as new trade wars are launched. We have been down this road before.

Many manufacturers, retailers, farmers and families that supported the Tax Cuts and Jobs Act would later question whether the juice from the tax cuts was fully worth the squeeze from tariffs and the cost of restructuring their supply chains.

During President Trump’s first term, as corporate America tried to dodge the torrent of White House controversy and public scrutiny, they clung to the benefits of his tax bill that boosted many a balance sheet — a slashed corporate rate, 100 percent bonus depreciation and incentives for investment abroad.

But the trade disputes with China, Europe, Mexico and Canada that followed increased prices on everyday items and blunted the net benefit of the tax cuts. Foreign countries retaliated against American goods. Farmers were crushed as foreign countries reduced imports of corn, soybeans and key commodities. Taxpayers eventually stepped in to bail out a critical U.S. industry.

With the Tax Cuts and Jobs Act set to expire later this year, one of the biggest political fights of 2025 will be over another tax tradeoff. So far, Republicans have struggled to align on a strategy. The compressed calendar and a razor-thin Republican majority gives every lawmaker leverage to demand their own priorities. Last week, the Senate passed its version of the budget bill. The House will likely bring up its budget resolution this week.

Trump and some Republicans have said that tariff revenue will play an even greater role footing the bill than in 2017. But just extending the 2017 tax cuts for another decade will cost $4.6 trillion. And that huge price tag does not include many campaign promises, such as cutting the corporate tax rate to 15 percent, ending taxes on tips, overtime, and Social Security, increasing border security funding and bolstering natural disaster recovery efforts. Meanwhile, swing state Republicans have threatened to reject any tax bill that does not increase or remove the limit on deductions for state and local tax bills.

The math has no opinion. When you add all these items to the budget wish list, the Trump plan will blow an even deeper hole in the budget deficit. That’s why tariffs could do even more to foot the bill than in 2017.

The new tariffs Trump announced this month will raise costs for American families and producers. Allied countries who feel betrayed are going to retaliate, further threatening American exports and American jobs. Companies that could find themselves in the crosshairs cannot afford to sit on their hands as the drama unfolds in Washington. They need to prepare for many different scenarios and consider three key steps.

First, they must proactively identify when it makes strategic sense to speak out boldly on issues with few champions and the biggest potential payoffs. If there are specific tariff exemptions that would have an outsized impact on a company’s bottom line, it should say so.

Second, they need to find unique allies and unconventional partners who can join a broad coalition and help prevent the impact of any tariff increases. For example, automakers around the world that will bear the brunt of Trump's steel and aluminum tariffs should speak out about the damage it will do to this critical industry.

Lastly, they should highlight local investments and emphasize relationships with key suppliers that could be threatened, as well as the risks to consumers and customers in key congressional districts.

While the outcome of the budget fight in 2025 is murky, we know that the tax and trade decisions will have massive consequences for companies around the world and everyday Americans.

Once Washington descends into another fiscal fight, and hard choices are put before the American people, the ground may shift. But as we saw during the Super Bowl, defense wins championships. Companies would be wise to identify key priorities, unique allies and the red lines that require the courage to speak out against trade and economic policies that will hurt the bottom line.

Adam Hodge is the former assistant U.S. Trade Representative for Public Affairs and is currently a managing director at Bully Pulpit International, where he co-leads the agency’s tax and trade offering.

What's Your Reaction?